Words wield remarkable power in shaping perceptions and facilitating understanding. For a couple of years now, we have observed that the word ‘pricing’ for many teams does not cover the full modern, and more strategic, role and intent – and in a sense is simply not the right word.

At our EPP forums (see

https://www.pricingevents.eu) we had interesting discussions with leading pricing practitioners as i.e. Daniel Cho (Philips Healthcare), Arnaud Potiron (Michelin), Hans Demeyere (Boehringer Ingelheim International GmbH), Mateusz Kędziora (Hempel), Gabor Kapus (Schneider Electric), José Vela (Spandex Group), Daniel Lindner (Accenture), Nazar Lukasevuch (Hilti) and Marcus Demmelmair (Horváth) – all contributors to this article.

We concluded that the term 'pricing' should be re-evaluated based on the evolution of the role in many organizations

There are today indeed multiple challenges and irritations with using the word ‘pricing’ :

a. the word has no proper translation in many languages other than English (see Appendix A-1) ;

b. ‘pricing’ is – because of the above - often perceived by management teams as ‘price setting’- or is narrowed to managing ‘operational processes’ only

c. and not covering the full, modern, strategic role and intent.

Hence, we hear increased voices, both from practitioners' and consultants' sides, asking for a reflection on the use of the word ‘pricing’.

The topic is clearly under discussion.

Why the word ‘pricing’ is often wrong (for many teams)

First, there is a problem with the translation of the word pricing, very often confusing management teams all over the world.

Translation of the word ‘pricing’ in other languages is a nightmare. There is simply not such a word in most languages. As a result, it’s usually translated as ‘price setting’ or ‘price management’ (e.g. Spanish, French, German) which refers to the operational aspect of ‘pricing’ only. And while you can live with the fact that your friends do not fully understand what you are doing as a ‘pricing manager’ – it is worse when your company’s C-suite also does not perceive the full potential of your role because. Thus the word ‘pricing’ does not always help.

Most translations indeed refer to ‘pricing’ as ‘price setting’ (only) – while in many other countries (e.g. Poland, Belgium, Spain, etc) the term ‘pricing’ is commonly left untranslated. It is also worth noticing that in some languages ( e.g. Hindi, Chinese, Latin) the word ‘pricing’ makes an interesting link with ‘value’

But in a nutshell: the word ‘pricing’ is simply confusing for many, and more importantly often perceived as a ‘functionality’ - an operational process that needs to be optimized.

Secondly, and probably more important: the word ‘pricing’ just does not cover the full potential of its role and intent.

During the last decade, we have seen the rise of ‘commercial excellence centers’ with the purpose of improving go-to-market processes and improving sales force effectiveness. We also observe that - in some organizations ‘Pricing’ is seen as a ‘lever’ of commercial excellence – while in other organizations ‘pricing’ and ‘commercial excellence’ have clearly different missions and intent. We will come back on this later.

Thirdly : the role of ‘pricing’ undergoes a true revolution

Over the last 2 years, due to the higher inflation rates, firms have not only been hiring more pricing professionals but also broadening the scope of the ‘pricing’ responsibility.

Due to increased digitalization of channels, the urge to change prices faster (and get data availability faster), and also the rapid growth of machine learning and algorithm-driven applications; the teams need broad business acumen to be able to align marketing, finance, sales, data management, and IT

And with markets becoming faster, more digital and much more dynamic, many organizations are today pushed towards new monetization strategies such as subscription models, dynamic pricing plans, pay-per-performance, pay-per-use, outcome-based pricing and other monetization plans – impacting the operating model and requiring organisational change to make it a success.

As a result, the new ‘pricing’ teams continue to become more critical than ever for their companies in enabling profitable growth strategies. The role of the ‘pricing’ professionals has evolved from (very) operational to much more strategic, becoming a solid wingman for business leaders in their strategy deployment.

Finally: in many industries, the profession has already evolved into new disciplines as: RGM (Revenue Growth Management), Revenue Management, and Yield Management. And some practices (such as RM) are used in multiple industries, making it even more ‘blurry’ for outsiders (read management teams) to see the whole picture.

Some demistifcation is welcome.

In fmcg/cpg : pricing is only one of the levers of “RGM” (Revenue Growth Management) .

In airlines and hospitality, the role is often different and defined as “Revenue Management”, which is based on dynamic capacity pricing (filling the capacity at the highest possible prices, using advanced forecasting and algorithms).

While in the cruises and leisure industry, we also see a role - besides RM (Revenue Management ; basically filling the boat at different prices based on micro-segmentation) - defined as “Yield Management”: maximizing the margin/client ‘on board’

But none of those names cover the role and intent in B2B industries, where ‘pricing’ managers are also involved in developing new monetization strategies, implementing strategic change in business drivers and implementing regional profit strategies.

When we have a look at the Linkedin profiles & job offers it’s obvious that many are trying to differentiate the job titles ranging from : director of pricing and revenue generation, director of pricing and margin generation, director of margin enhancement programs, revenue manager, margin manager, pricing and commercial excellence manager.

So let’s discuss another name for ‘pricing’.

Focus on the rise of the role of “Commercial Excellence”

To fully understand the role and intent of the ‘pricing’ function it is good to also observe the rise of ‘commercial excellence centers : proving their impact in streamlining effective go-to-market processes and improving sales force effectiveness.

We observe that some organizations tend to add ‘pricing’ as one of the Com-x levers. That is, of course, a valid option if you see ‘pricing’ as a ‘process that needs to be optimized’. And in that sense, we understand the choice of some organisations to add ‘pricing’ to ‘commercial excellence’. But by making this choice, it also could mean it is ignoring the more ‘strategic’ role and intent of the function.

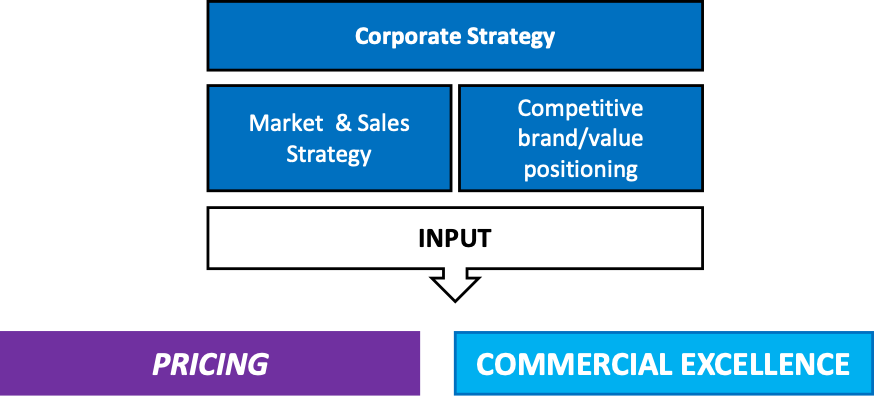

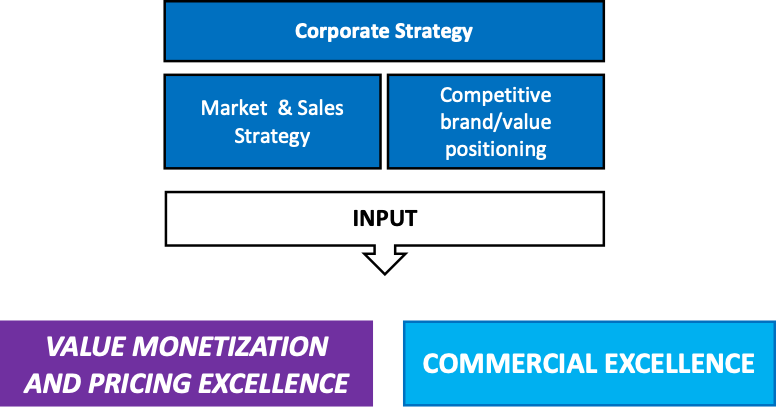

We rather see Commercial Excellence working in a close relationship with ‘pricing’ instead of ‘pricing’ being one of the Comex ‘levers’. As visualised below ; commercial/market strategy is (of course) the input for both ‘pricing’ and ‘commercial excellence’. And commercial strategy follows of course corporate strategy. If we put it into a visual :

(Pricing and Comex follow market strategy).

In this setting : ‘pricing’ defines the price strategy and guidance - with ‘commercial excellence’ ensuring an effective go-to-market and sales process. The role and intent of the ‘pricing’ function is also very strategic by nature and responsible for developing new monetization models and full value monetization (see further).

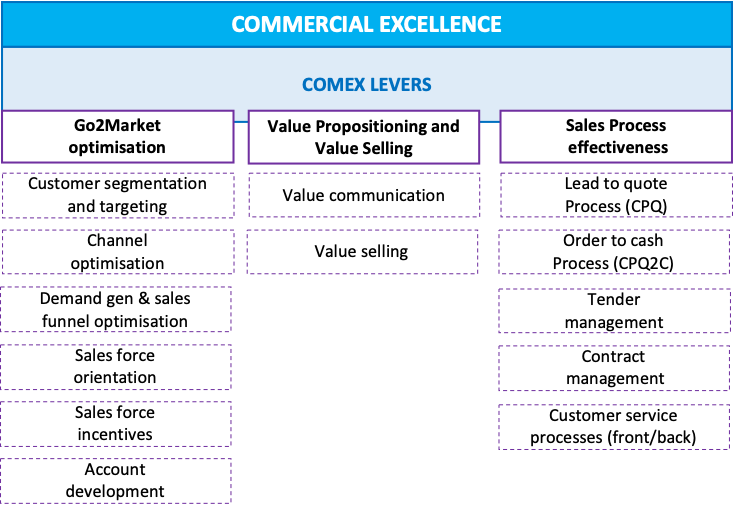

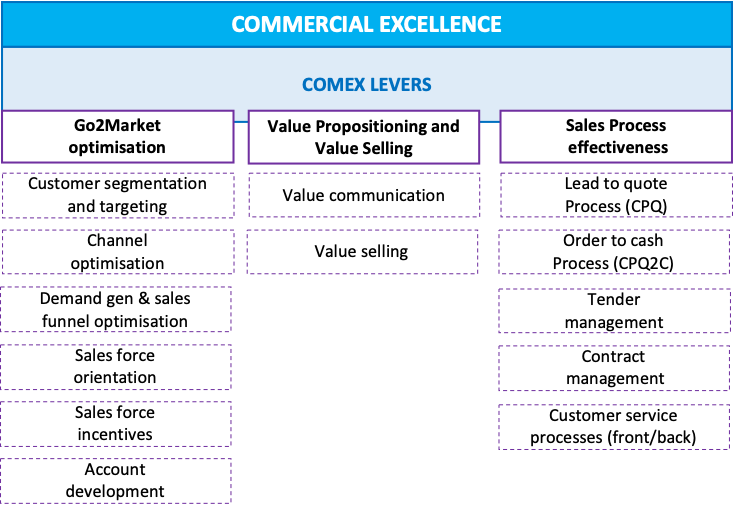

When ‘commercial excellence’ and ‘pricing’ work as twins, in close relationship (instead of pricing as a com-x lever), the role of commercial excellence is focused on :

- optimized go-to-market approach,

- optimized demand generation,

- increased sales process effectiveness,

- increased sales force efficiency,

- improved value communication,

- value selling practice.

(The ‘levers’ of Commercial Excellence – here not including ‘pricing’).

Towards a better name for the role and intent

It is clear that the role of the ‘pricing’ team is ‘strategic by nature’ (pricing is strategy). There are of course multiple strategic drivers to compete and outperform your competitors in your markets (and yes, a volume strategy is one of them, but there are many more) – but ‘pricing’ leaders are always solid wingmen to the CEO, helping to realize profitable growth and drive the change when change is needed.

Of course there are also many ‘operational pricing roles’ that need to be organized by the ‘pricing teams’ as well (such as product/service pricing, maintenance of the price book, organizing regular pricing reviews, list price optimizations, check price compliancy, etc.).

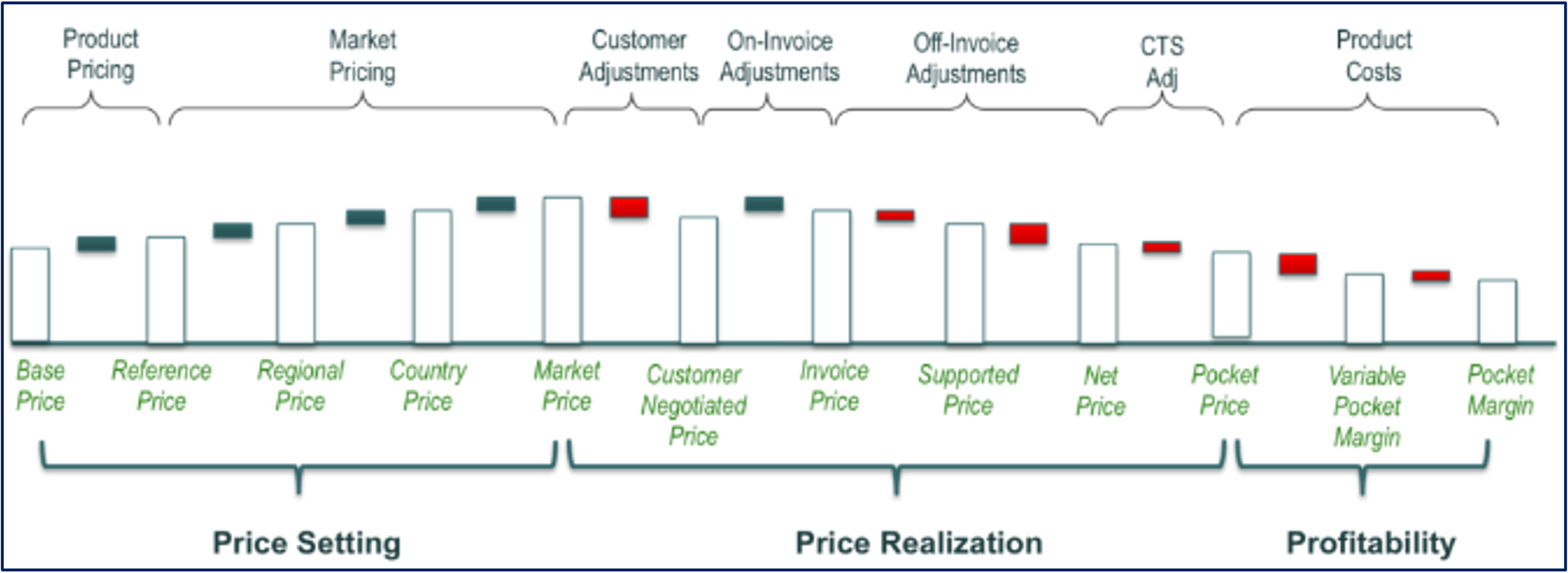

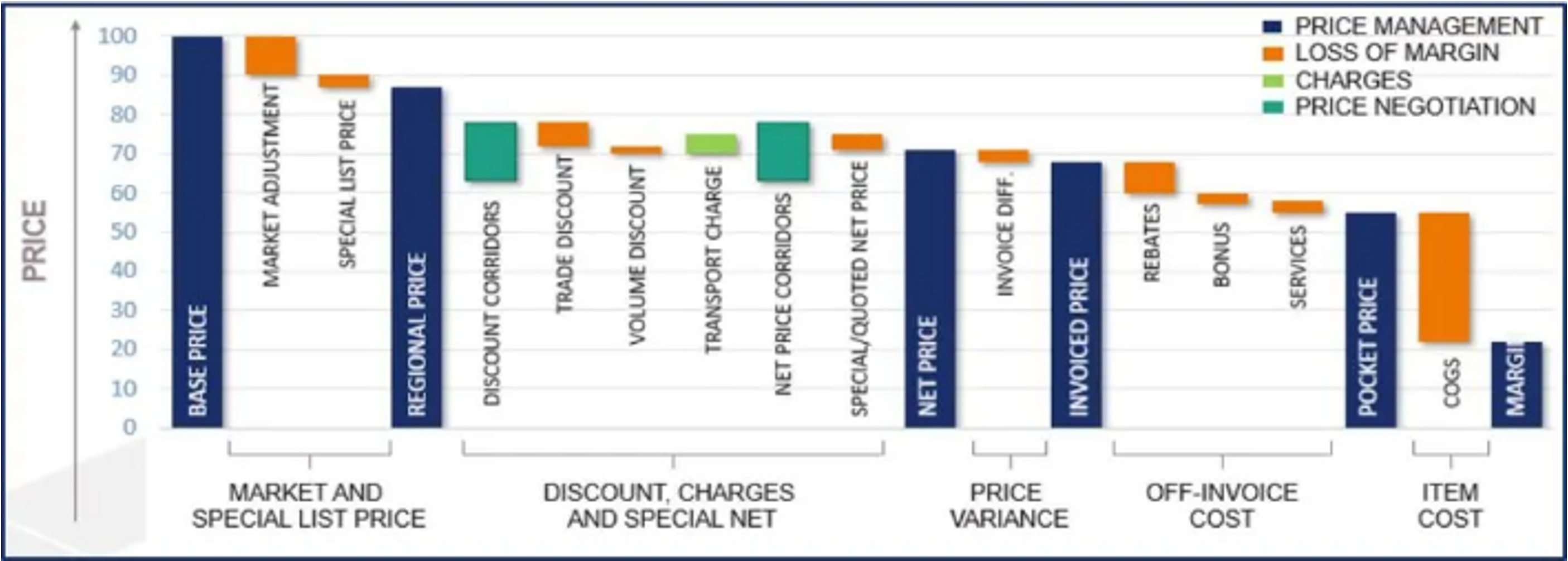

And looking at the ‘price waterfall’ structure to visualize where the team has an impact (see visual), we see that the modern ‘pricing’ teams cover responsibilities from (left) list price to (right) pocket margin. From top-line revenue to profitability (net margin).

Of course, the role has only an indirect impact on ‘Volume’ (that can be production-driven, channel-driven, sales coverage, go-to-market driven) or ‘Mix’ (how to distribute within markets, products, segments - or ‘Configuration Mix’ (ie selling more service or less, selling full config or lean config) – or ‘Cost’ (including cost-to-serve).

Therefore, claiming ‘revenue management’ in a B2B role is not correct, nor claiming responsibility over ‘margin management’ (this is a product management or commercial accountability). However, the teams HAVE the responsibility of spotting revenue and margin improvement opportunities and orchestrating the stakeholders towards action.

Hence the need for ‘orchestration’ and ‘trusted advisor’ skills in the teams are crucial.

Finally, in their role as ‘pricing leaders’, there is also a ‘strategic role’: developing new monetization strategies, implementing strategic change in business drivers – and orchestration with sales/marketing/product management in implementing the (regional) profit strategy.

Bringing it together

Seen the changing role and intent – ‘pricing’ includes 2 components: a ‘pricing excellence’ component (with focus on making ‘pricing’ more effective, efficient, and compliant) – and another, more strategic, ’value monetization’ component.

Hence, we suggest a better and extended name for the ‘pricing’, covering both roles :

“Value Monetization & Pricing Excellence”.

In this set-up : both ‘VMP-x’ and ‘Com-x’ support achieving the overall commercial strategy goals, requiring market/brand strategy as the input. These two crucial functions continuously support each other towards the commercial goal realisation, with Com-x focused on commercial process optimization and the development/implementation of digital tools supporting sales process, incl. CRM, SFA, E-commerce and yes also pricing software.

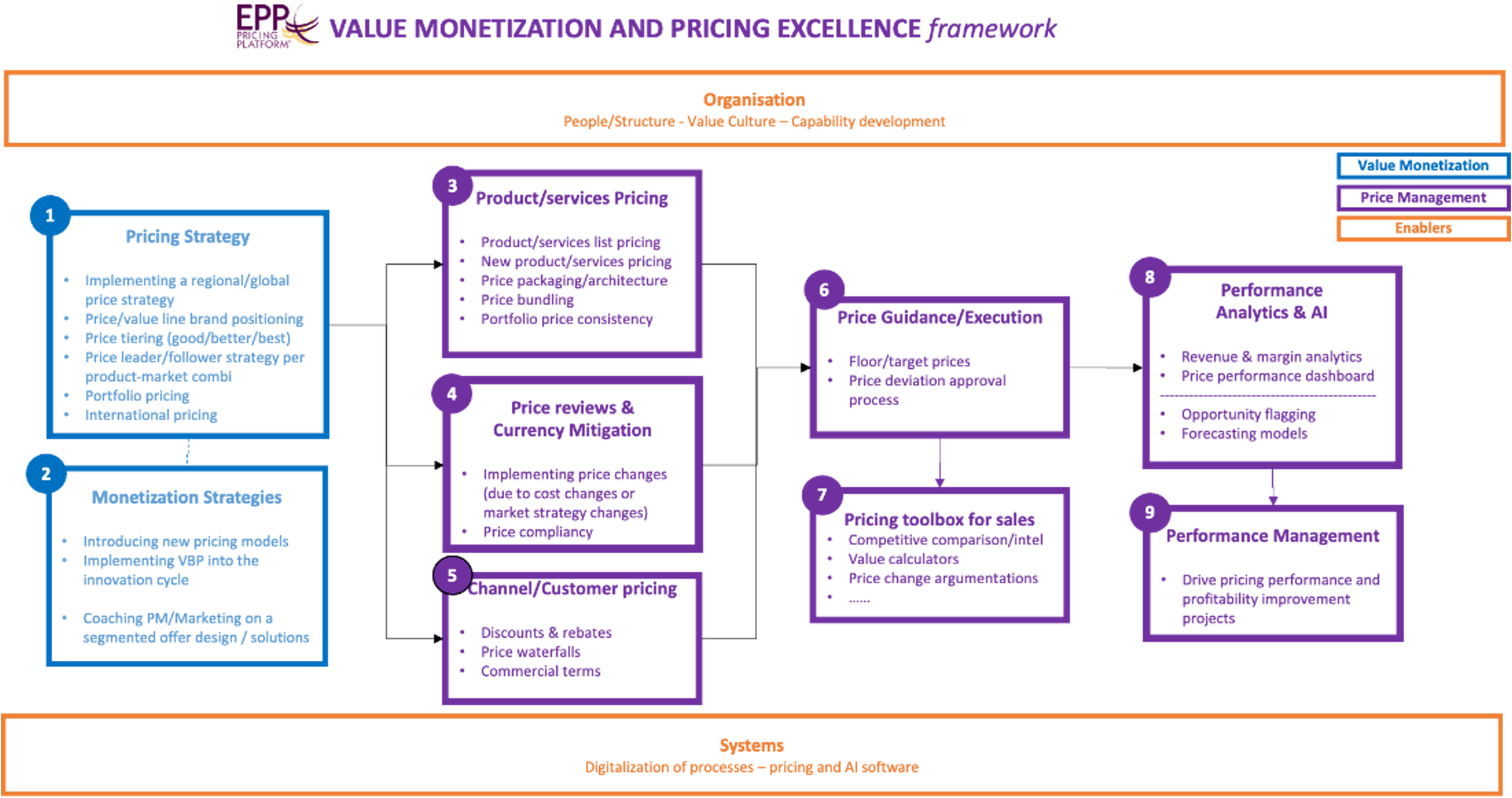

While setting strategic pricing guidelines and developing new monetization models are, together with installing transactional pricing control, price setting processes, price guidance etc are accountabilities of the ‘VMP-x’ team (see below).

The bottom line is : the core role of Commercial Excellence is to maximize the capabilities of sales team and tools ensuring successful/effective and efficient realization of the go-to-market strategy.

It includes activities such as increasing sales effectiveness, e.g. by improving salesmen's negotiation & value-selling skills, preparing incentive plans both for salesmen & customers (e.g. in order to target selected products), implementing supportive analytics & tools (e.g. video-chat for customer with interactive catalog) as well as increasing sales efficiency, e.g. by KAM’s performance measuring, customer visits’ routing optimization, selecting proper distribution channels.

Therefore, the main client and partner for Com-x is the Sales department.

‘VMP-x’ on the other hand is accountable for the complete process of value monetization.

In order to be successful in today’s volatile markets, the ‘VMP-x’ role is to understand the company’s business model and market strategy, it’s position in the entire market value chain, to assess the company’s pricing power resulting from this position, and eventually to steer the prices, portfolio and conditions (e.g. discounts, rebates, payment terms) towards the desired commercial goals. Finally, ‘VMP-x’ is also leading in developing new monetization plans to capture the true value of innovations in B2B organisations.

Successful sales excellence happens within clear guidelines on price/value positioning and strategy -and innovative monetization plans.

The transition from the vague - and limiting term - "pricing" to the holistic concept of "Value Monetization and Pricing Excellence" brings the two main roles of the team together and signifies a pivotal shift in our understanding of the complex interaction between the business strategy, products, markets, channels, consumers, and business objectives.

Value Monetization & Pricing Excellence covers within this context the following dimensions:

- Pricing Strategy: Setting the overall strategic guidelines for pricing, including the value proposition, and competitive and international price positioning.

- Monetization Strategies : Introducing new pricing models, implementing value based monetization in innovation cycles, etc.

- Product & Service Pricing: Setting list prices for products or services, price pack architecture and leveraging state-of-the-art pricing methods such as value based pricing, economic value assessment, performance based pricing.

- Channel/Customer Pricing: Differentiating prices across customer segments / customers, e.g. via discounts (on-invoice) and rebates (off-invoice)

- Regular price reviews : Driven by cost, strategy or market changes

- Price guidance – setting floor and target prices and managing the price deviation process

- Pricing Toolbox : including competitive price intel, value calculators, etc.

- Ensuring price compliancy

- Performance Analytics & AI : Generating revenue and margin reporting, including building price effectiveness dashboards and continuous identification of margin improvement potentials together with AI driven simulation capabilities

- Performance management : Driven margin improvement and price performance projects.

Enablers :

- Organisation and governance : Managing the price organisation, developing the capabilities, the pricing governance and promoting a value culture.

- Tools & Technology: managing the pricing system and tool landscape to ensure high degree of automation in pricing

Bringing it together in the new Value Monetization and Pricing Excellence framework :

Conclusion :

The shift from ‘pricing’ towards ‘Value Monetization and Pricing Excellence’ not only captures the multifaceted nature of this critical function but also underscores its role as a critical strategic wingman to the top-management.

It also reflects the broad anchoring within the organization – VMP-management has a crucial ‘orchestration’ role between product management, sales, marketing, and finance. All relevant stakeholders need to act together in a coordinated way to realize the full profit optimization potential. This requires serious not only ‘orchestration’ but also important ‘change management’ skills within the VMP leadership and team.

Finally, the linguistic upgrade from ‘Pricing’ to ‘Value Monetization & Pricing Excellence’ will help to put ‘VMP-x’ more prominently within the organization. It empowers organizations to foster meaningful and valuable customer relationships and drive sustainable growth initiatives.

Used in job titles, we suggest the title : ‘Value Monetization and Price Management’.

Appendix A

1. Popular translation of 'pricing'

Spanish : Fijación de precios

Russian : Ценообразование

Arabic : تسعير

Chinese : 定价

Hindi : मूल्य-निर्धारण

French : Gestion des prix

Portuguese: Precificação

German : Preisgestaltung

Ukrainian : Ціноутворення

Dutch : Prijszetting

Finnish : Hinnoittelu

2. Linked in post - Jan Y. Yang

In a recent Linkedin post, Jan Y. Yang (Managing Director China at SK) had the same observation: the word pricing is making things more difficult. It’s simply the wrong word. Also in Chinese the translation is different.

Jan Y. Yang : As a pricing consultant, I have been struggling in China, a lot. The root cause: pricing is perceived to be a functional topic. As such, it does not have sufficient attention of the management, or simply put, the big boss. We have been trying really hard to preach that pricing is of strategic importance, as it deals with value management in essence.

When we talk about pricing (定价), the immediate association is with price not value. In reality, the very Chinese character 价 implies both price (价格) and value (价值). It was a eureka moment for me. My final take-away: pricing=value before price

According to LinkedIn conversation with Nikhil Kalla (Global Pricing Manager at Ingersoll Rand), the similar situation occurs in Hindi where मूल्य-निर्धारण means ‘price setting’ but the word मूल्य separately means both ‘price’ and ‘value’, while most often the ‘value’ appears even at the first place among dictionary translations.

PS : In Latin = Pretium (price/value)

Looking back : the raise of ‘pricing’.

1846 – A. T. Steward & Co has established a system of fixed prices for their goods. The start of the end of “natural” price differentiation (based on haggling skills), the beginning of price transparency.

1855 – Aristide Boucicaut has implemented price tags in his department store “Le Bon Marché”. Huge step on the path to price transparency.

1890’s – Price rounding, e.g. 9,99 became popular. The very beginning of behavioral pricing.

1970’s – After deregulation of airline tickets’ fares in the U.S. in 1978 the dynamic price differentiation systems started to be developed by several airlines. The modern pricing was born and soon has started to spread across other industries resulting in creation of the new profession.

1987 – Thomas T. Nagle et al. published “The Strategy & Tactics of Pricing” incl. the patented Economic Value Estimation (EVE) model. The era of strategic pricing arose.

Until 2000 – that’s almost 25 years ago - the price strategies and tactics were mainly seen as a ‘local’, commercial, role. Countries and even regions within countries made very fragmented and uncoordinated price decisions. The need for a more aligned approach was very often not a priority.

Two evolutions triggered the change and the rise of a specific function responsible for ‘pricing’.

First, Europe and more recently many countries in South America switched towards a one-currency market (introducing euro or dollar list prices). Prices within those pricing zones became more transparent, and a harmonized price list within a regional price band guidance became necessary.

Secondly, the internet made price transparency even bigger in many markets. Since then, the ‘pricing’ maturity and capabilities of B2B companies have developed a lot : most larger companies installed pricing teams (although operating at different maturity levels and different roles/structures) and the teams have grown a lot. Pricing consultancy shows double-digit growth rates, and more and more pricing software vendors and data technology companies support the capabilities with tools and systems.

The role and intent of ‘pricing’ has changed a lot the last decade – and the rise of commercial excellence has also impacted the role of ‘pricing’ in many companies.