Dynamic pricing has the potential to support companies in developing more targeted pricing approaches by tapping on the growing amount of customer and competitive data collected. Dynamic pricing refers to the automation of price changes based on one or several contextual variables, such as time, demand, inventory levels, capacity, location, competitive prices, or external events. In most cases, dynamic prices can be adjusted in minutes. This approach to pricing has become increasingly popular in the retail industry – especially among online retailers - driven by the success of the implementation among major retailers such as Amazon, Walmart, and Target. However, implementing dynamic pricing for physical – or offline - retailers can be challenging, and they must overcome several hurdles to make it work effectively.

Dual-channel pricing

One of the main challenges is a dual-channel pricing problem, which occurs when integrating dynamic prices for physical and online stores. Typically, physical retailers base their sales on offline channels such as brick-and-mortar stores, vending machines, and kiosks. However, more retailers have developed their online sales channels due to several factors, including the recent COVID pandemic and rapid changes in technology and consumer behaviour. Interestingly, some pure online retailers are now developing a physical retail channel with a similar pricing challenge. This multichannel approach requires retailers to offer dynamically optimised prices that account for differences in the demand stream of channels, management of cross-channel revenues, and differences in fulfilment and delivery costs between channels.

Implementation

The implementation of dynamic pricing among online retailers has been documented for some time now, particularly among major e-commerce platforms and even retail platforms such as Shopify, which allows small online retailers to implement dynamic pricing without major investments in technology. Moreover, there is considerable growth in dynamic pricing software that considerably lowers the barriers to implementation for major online retailers.

However, in physical retailing, implementation is still a major challenge. Manually adjusting prices in the physical store will be costly, time-intensive, and in most cases, unfeasible. To this extent, physical retailers are faced with three alternatives for implementing dynamic pricing in the store:

- Digital price tags or e-tags. They will allow the retailer to adjust prices without relying on the store staff to change price tags manually. Some tags will have a larger display or even a colour display, allowing the retailer to present more information. The downside of these price tags will be their costs which might be prohibitive for some retailers.

- Showrooming. This implies that the store showcases the products, but customers must purchase the product online. The product can even be in stock at the time of purchase.

- Fewer categories. Working with fewer categories, such as some key value categories (KVC) or even some key value items (KVI), rather than with the whole assortment, will allow the retailer a more straightforward implementation and better focus on key categories and products.

- Customer experience

Dynamic pricing has been widely adopted in various industries, including airlines, hotels, e-commerce platforms, and theme parks. While dynamic pricing has many benefits for retailers, its impact on the customer experience is a topic of ongoing discussion. On the one hand, dynamic pricing can provide customers with more affordable prices during off-peak times, making goods and services more accessible. For example, retailers can offer discounts during slow sales periods to entice customers to purchase products. Retailers can also use dynamic pricing to provide personalised pricing and reward customers based on their behaviour and previous experience.

On the other hand, customers are used to dynamic price changes when purchasing an airline ticket or booking a hotel room. Still, they need to be used for dynamic price changes for common goods, especially in a physical store. Frequent price changes can potentially alienate customers, thus jeopardising the entire customer experience. Retailers must ensure that their dynamic pricing algorithms help customers perceive a benefit from these price changes. Dynamic pricing can also lead to price discrimination, with potential legal ramifications if not communicated correctly.

Furthermore, the dynamic pricing implementation should reinforce the price image chosen by the retailer; whether it is the image of a discounter or a premium retailer, the new dynamic pricing approach should match that image.

Prices should be consistent among different channels. When shopping online, some retailers even ask customers for their zip codes to match costs to nearby stores, thus ensuring price alignment. Moreover, retailers should reinforce the desired perception of prices by communicating reference prices, using price anchors, and establishing price guardrails to prevent prices from moving outside a range of price acceptance. Using indirect tactics, such as the rewards program, can help retailers promote a positive perception of the dynamic pricing implementation.

Furthermore, physical retailers must be careful that dynamic pricing is done in the product categories where it is justified and based on significant changes in the chosen contextual variables. For example, a retailer can adjust prices when changes in demand reach multiple thresholds rather than changing prices just for the sake of it.

Data quality

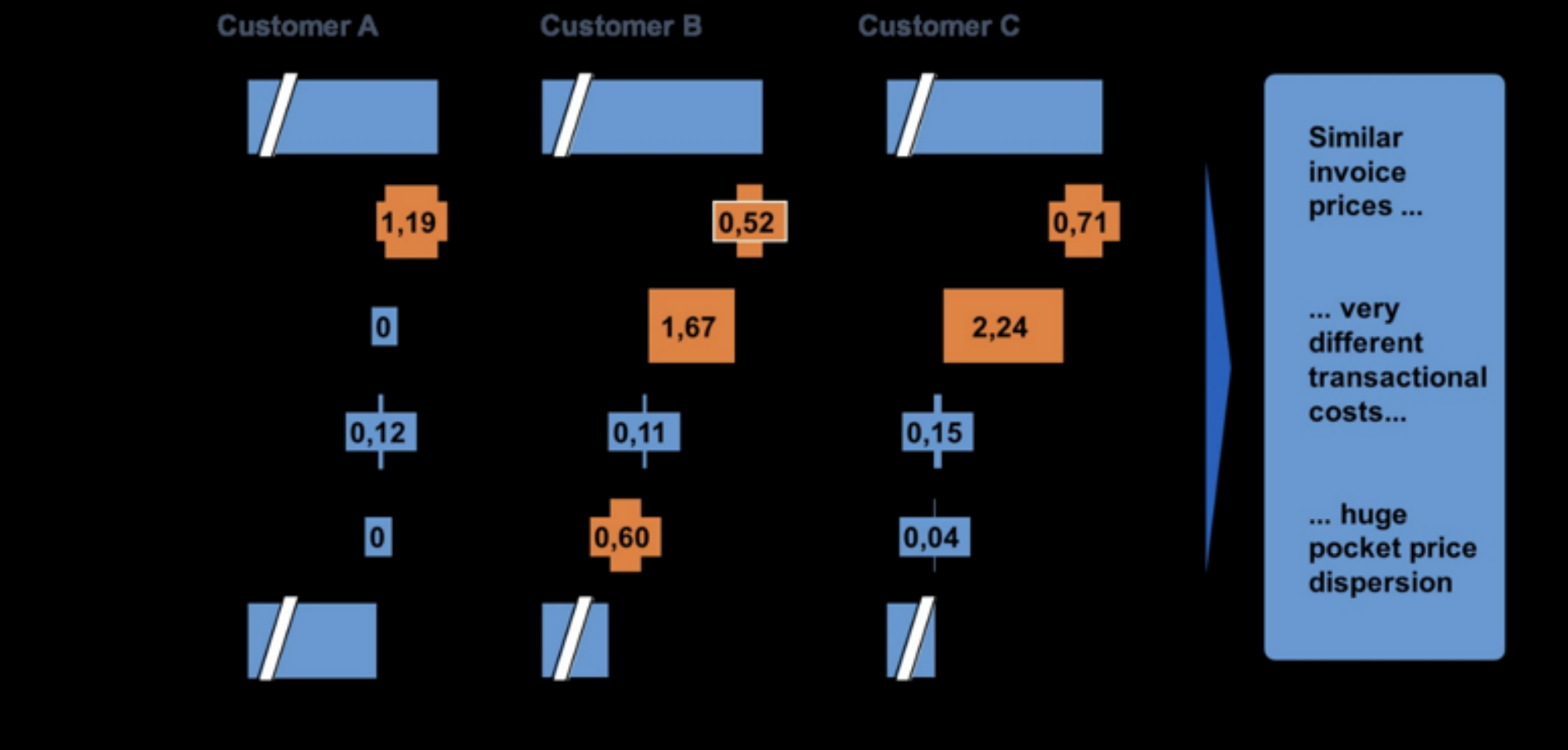

The quality of the data used in the dynamic pricing algorithms is a major concern for any dynamic pricing implementation. The effectiveness of dynamic pricing strategies depends on the accuracy and completeness of the data used to make pricing decisions. Bad data can jeopardise a dynamic pricing implementation. Moreover, in physical retailers, there is the additional challenge of deciding how to account for differences in store operating costs, storage, and order management and fulfilment. Moreover, physical retailers must decide which local contextual variables to use; will weather or events at the local level be relevant to use?

Objectives and profitability

Drivers of dynamic pricing implementation among physical retailers are customer acquisition, retention, and switching customers from competitors. Moreover, dynamic pricing can lead to long-term profitability in several ways:

Maximising Revenue: Dynamic pricing helps companies maximise their revenue by charging higher prices during peak demand periods and lower prices during off-peak periods. By doing so, they can increase their sales during off-peak periods and maximise profits during peak periods.

Managing Inventory: Dynamic pricing can help companies manage their inventory by incentivising customers to purchase products or services during slow periods. By offering discounts during slow periods, companies can reduce their inventory levels and avoid the cost of holding excess inventory.

Responding to Market Conditions: Dynamic pricing enables companies to react quickly to changing market conditions, such as changes in customer demand, competitor pricing, and market trends. By doing so, they can stay competitive and maintain their market share.

Increasing Customer Loyalty: Dynamic pricing can also increase customer loyalty by providing personalised pricing and promotions based on past purchases and preferences. By doing so, customers are more likely to return to the company for future purchases.

Improving Margins: Dynamic pricing can improve profit margins by increasing the price of products or services during peak demand periods. By doing so, companies can increase their revenue without increasing costs, leading to higher profits.

Dynamic pricing can help companies optimise their pricing strategy, increase revenue, and improve profit margins, leading to long-term profitability. However, the challenge comes when the implementation of dynamic pricing focuses on short-term profitability. For example, a retailer might ignore the importance of the out-of-the-door price. If customers end up paying more than what they used to, they could easily switch the purchases online or to another retailer, thus jeopardising long-term profitability.

Dynamic pricing can be incredibly complicated for physical retailers, particularly when considering a dual-channel pricing problem: keeping prices consistent among online and offline channels. By focusing on key value categories (KVC) or key value items (KVI), using digital price tags, or considering showrooming, retailers can reduce the complexity of the dynamic pricing implementation. Retailers can use dynamic pricing to enhance the customer experience by offering personalised pricing, ensuring that customers perceive a benefit from dynamic prices, and avoiding price discrimination and price gouging. Good data is crucial. Furthermore, dynamic pricing should focus on something other than keeping prices aligned with competitors but on achieving the desired objectives and long-term profitability.

Conclusion

Dynamic pricing presents a unique opportunity for physical retailers to optimise their pricing strategies, maximise revenue, and improve profit margins. However, implementing dynamic pricing effectively in physical retail requires overcoming various challenges, such as the dual-channel pricing problem, maintaining a positive customer experience, and ensuring high-quality data for algorithms. By focusing on key value categories and items, leveraging technology like digital price tags, and considering showrooming, retailers can simplify the implementation process. It is essential for retailers to ensure that their dynamic pricing strategies align with their overall brand image, maintain consistency across channels, and promote a positive perception among customers. Finally, dynamic pricing should prioritise long-term profitability and objectives rather than merely mirroring competitor prices. By addressing these challenges, physical retailers can harness the power of dynamic pricing and unlock its full potential in today's competitive retail landscape.