If you are lucky enough to have read Danilo Zatta’s excellent book “The Pricing Model Revolution: How Pricing Will Change the Way We Sell and Buy On and Offline”(1) , you would know that Pricing is the strongest profitability driver, affecting profits much more than increasing sales volume or reducing costs.

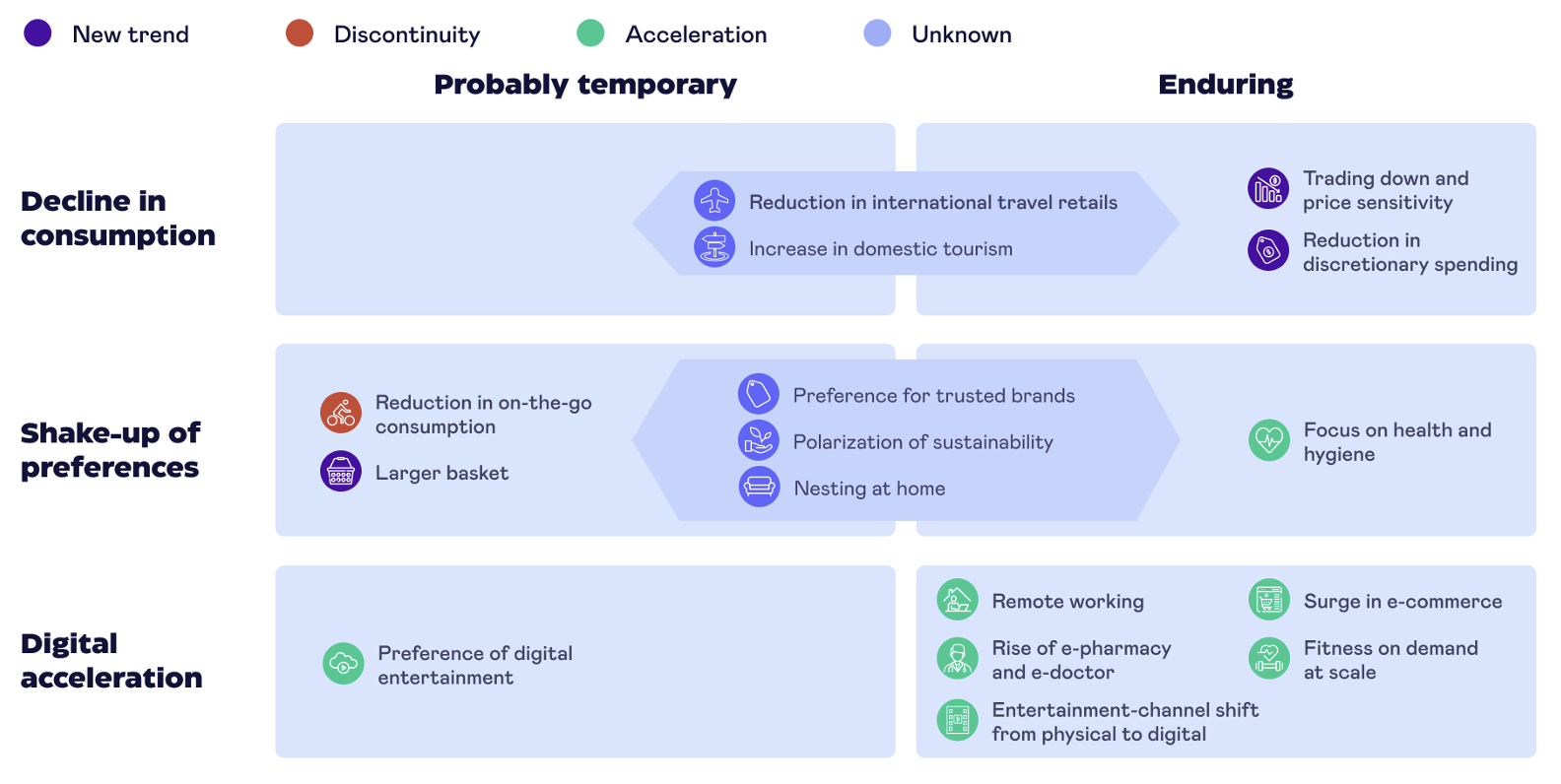

Admittedly, getting your pricing right has a strong impact on your profits, demand, supply, and overall business performance. However, the task itself is one of the most challenging since you have to consider multiple internal and external factors(2) while setting your prices:

- BUSINESS ENVIRONMENT:First, you need to understand the environment where you operate and sell your products. This includes the Macroeconomic environmentwith inflation, spending capacity, exchange rates, or other macro indicators, as well as Market conditions with competitors’ pricing, new technologies, supply shortages, or other market conditions.

- PRODUCT-MARKET FIT: Then you need to consider how well your Product fits the intended customer audience's needs. This includes the Product with all its features, specifications, bundles or packs, perceived quality, or other product-related parameters, as well as Customers with relevant customer segments, best-fit characteristics, or other customer-related factors.

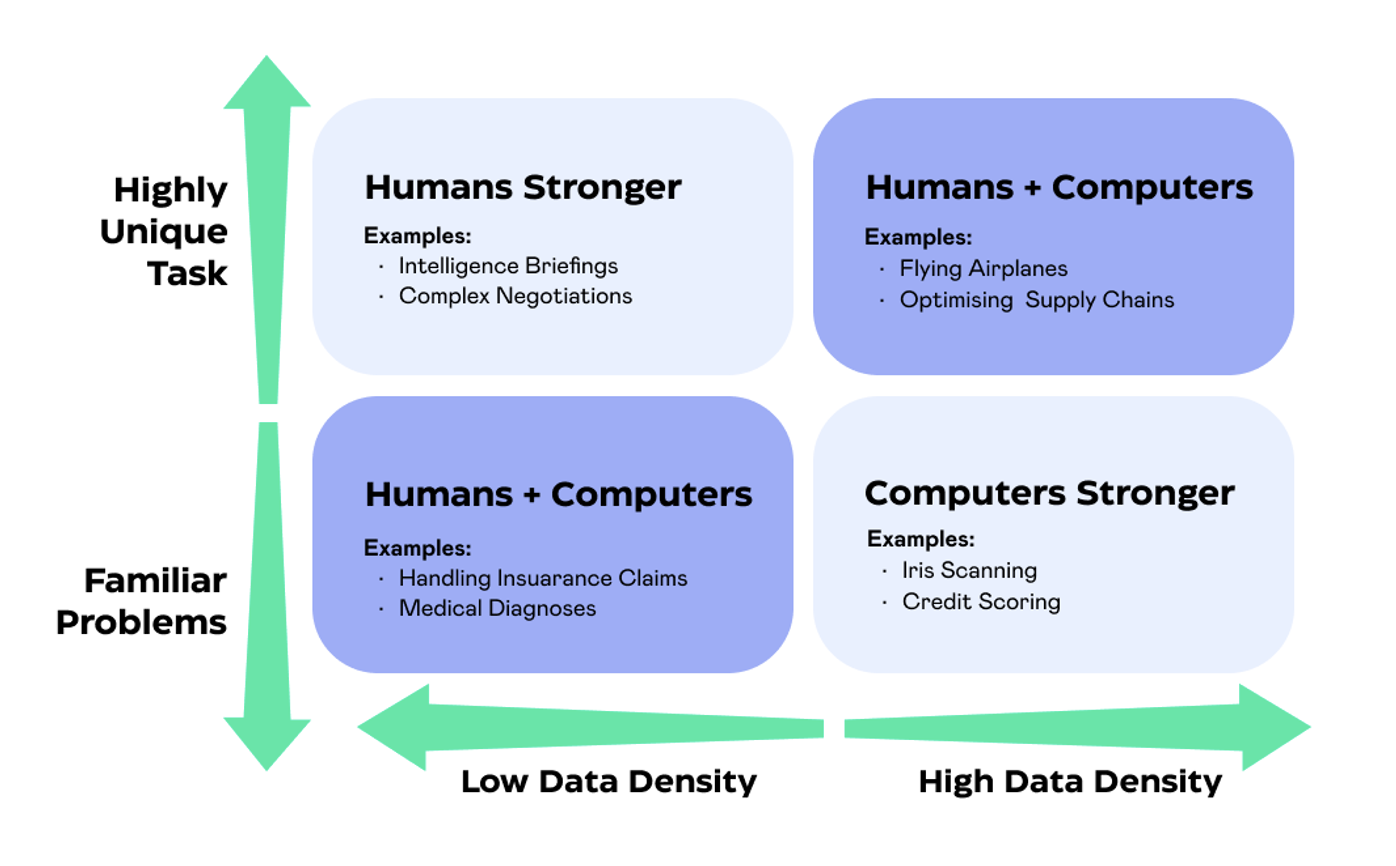

Despite the complexity of the pricing premise, you know some ground rules2, for example, that your chances of success increase with more competitive prices, combined with higher perceived quality, the right target audience, and favorable macro, country, or market conditions. But what you don’t know is how much these factors affect your pricing and sales performance, and this is exactly the point where AI gets into the picture to help quantify these dynamics.

AI is the talk of the town today and for a good reason. Following the wide release of ChatGPT in late 2022, AI hit the mainstream market, reaching a broader audience beyond technology enthusiasts and visionaries. Generative AI and well-known platforms like ChatGPT, BARD, Midjourney, and many other tools took the world by storm as people realized how valuable and user-friendly AI can be and started discovering its numerous use cases and applications.

But AI comes in many forms, and Generative AI, despite its current hype, is still at the beginning of its journey, capturing less than 5% of AI equity investments . The biggest slice of AI investments goes to more mature and proven AI technologies, including 𝗣𝗿𝗲𝗱𝗶𝗰𝘁𝗶𝘃𝗲 𝗔𝗜, which is the most relevant to Pricing.

In the following, we will explore the numerous applications of Predictive AI on Pricing, including a real-life customer case , but also refer to some relevant Generative AI applications.

Using Predictive AI in Pricing (5)

Predictive AI, also referred to as Predictive Analytics, involves the use of artificial intelligence and machine learning methods to predict and/or optimize future events or outcomes based on actual data and patterns.

The main application of Predictive AI in business and the economy is to:

- Apply statistical or econometric models on available information,including historical data (e.g., actual sales) or prospective data (e.g., pricing research).

- Recognize important patterns, such as estimating the demand curve (Fig. 1) or a sales trend.

- Generate important predictive insights, including sales forecasts, market trends, or optimized suggestions (Fig. 2), such as the best price for maximum revenue or profitability.

Predictive AI can help you make better or optimized pricing decisions with significant gains for growth, profitability, or other vital KPIs of your business. Evidence suggests that Predictive AI, incorporating econometric modeling, can help optimize pricing and increase revenue and other important KPIs even 2-fold while improving strategic business foresight with great accuracy, reaching 97% .

Let’s now explore some of the most important pricing use cases for Predictive AI and a real-life customer case(4).

Estimating the Probability to win and the Demand curve to optimize pricing(5)

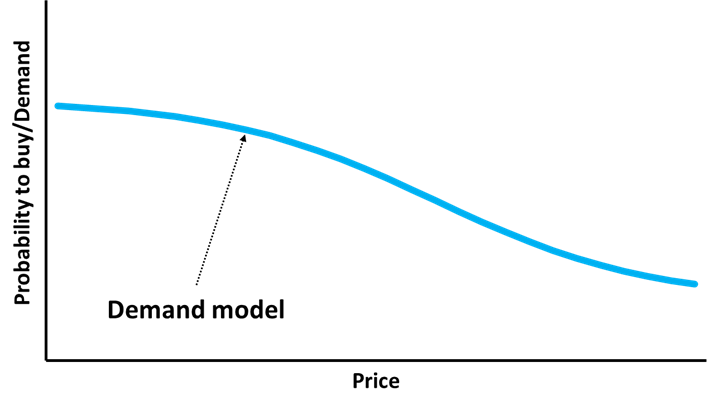

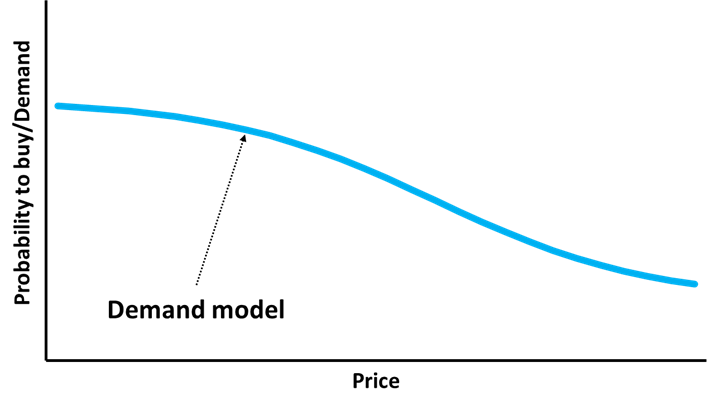

Pricing significantly impacts sales performance by affecting the customer’s probability to buy, but the question is how much. As anyone even slightly involved in Pricing knows, the answer lies in the Demand curve (Fig. 1), a chart with the price on one axis and the probability to buy or demand (probability to buy x opportunity size in units) on the other.

Fig. 1 The Demand curve

But how can Predictive AI help in estimating the Demand curve?

It does so by simulating the demand curve using a specialized AI-based Demand model and fitting it to actual data. “Fitting,” for the non-data science familiars, means that the Predictive AI system tries to change the model (usually its key parameters) repeatedly until its output resembles the actual data as much as possible. And how can you know if your model is good and you can trust it? By testing its prediction accuracy or how close the model’s estimate is to actual data with the smallest possible margin of error. There are multiple error metrics and testing methods, such as in & out of sample and cross-validation.

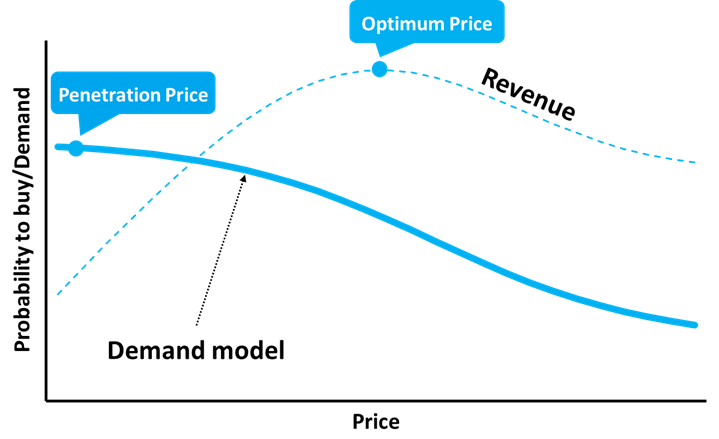

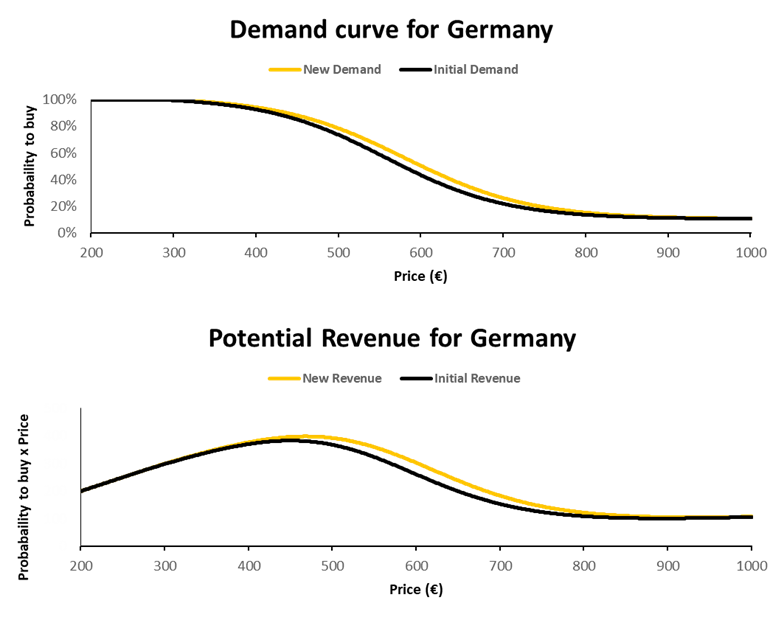

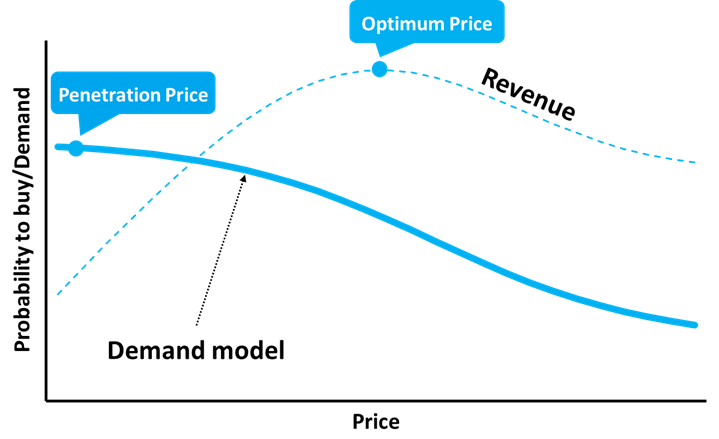

Once you have discovered the right Predictive AI model that adequately simulates your demand curve, this opens the door to generating multiple valuable insights (Fig. 2). So, you can use the model to estimate your probability to sell, your sales performance, and your profitability (assuming you have cost information as well) at any given price level. In addition, you can identify Optimal Prices that maximize your revenue or profits or the Penetration Price that allows you to maximize your success rates under certain restrictions of profitability or other KPIs.

Fig. 2 Predictive Insights using the Demand curve

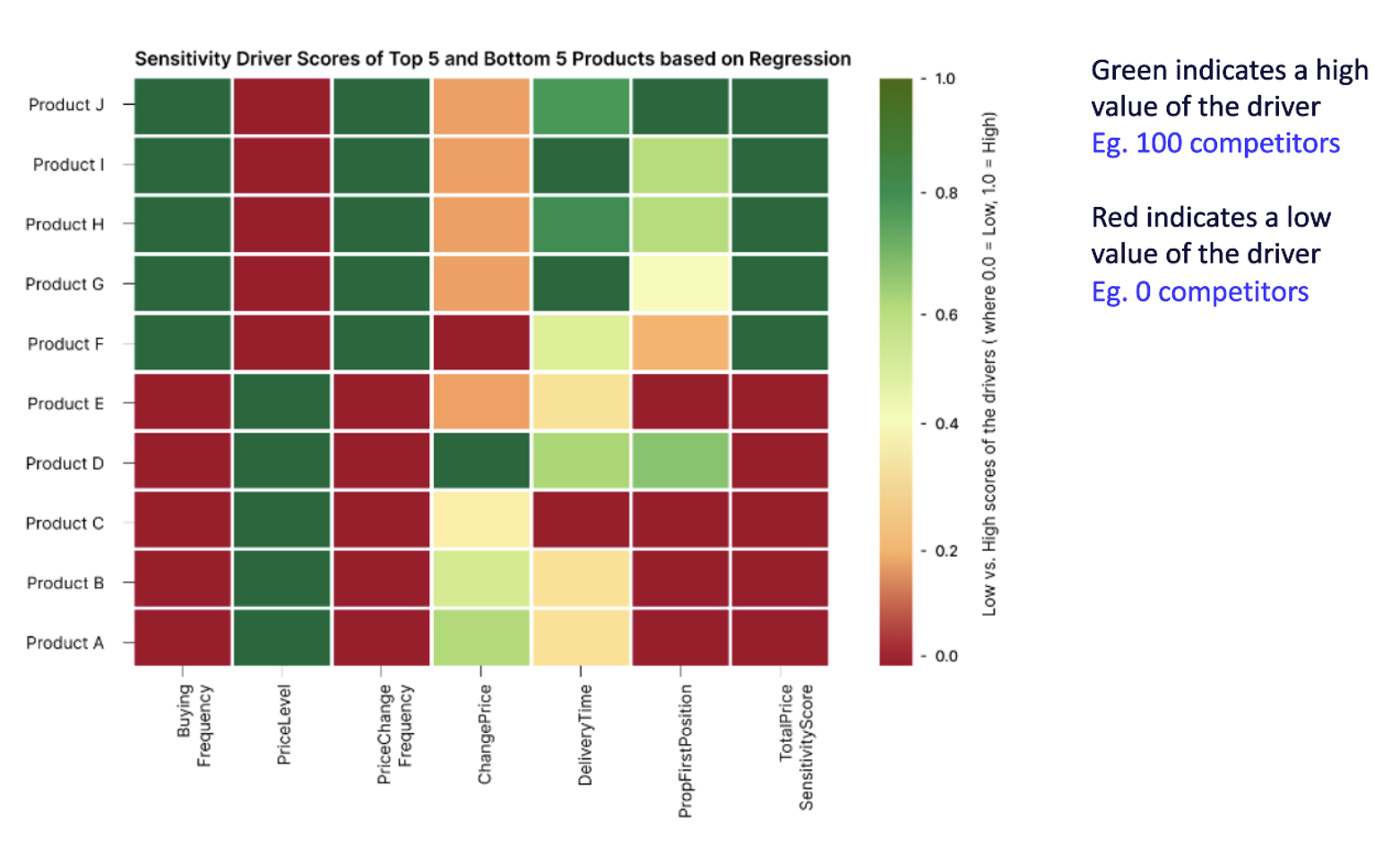

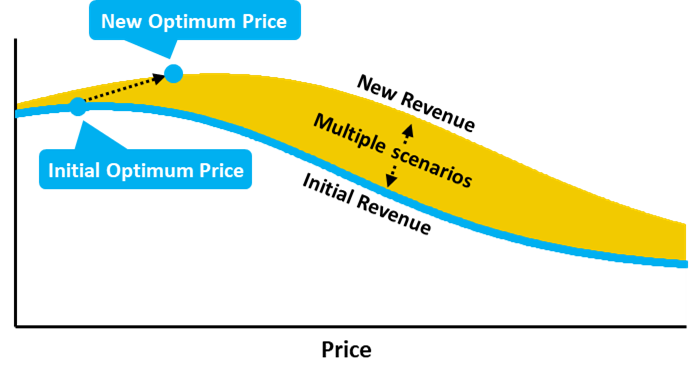

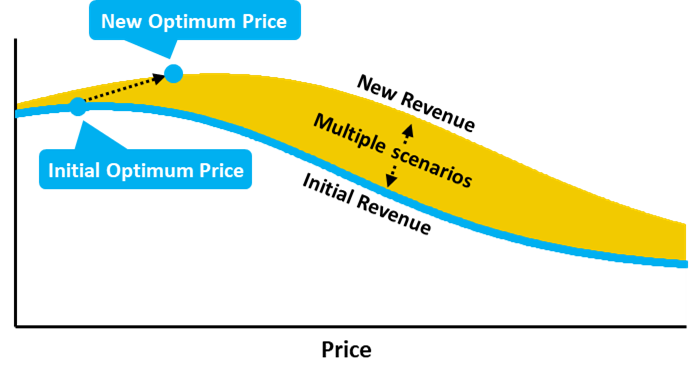

As already mentioned, Price is not the only aspect affecting sales performance. Several other factors are crucial in determining the Demand curve and should be analyzed when making pricing or other business decisions (Fig. 3). For example, when considering a specific country, inflation and changes in the average spending capacity can alter the perception of what is considered expensive or not. When competitors change their prices, this may influence your chances of success over new or existing customers. Also, the perceived quality of the product and the best-fit customer characteristics matter a lot. All these factors affect the customer’s probability to buy at any price point. In addition, sales performance can also be influenced by the target country and market size, product bundling, and customer size or type, just to mention a few critical factors.

Fig. 3 Multiple Factors affecting sales performance and pricing

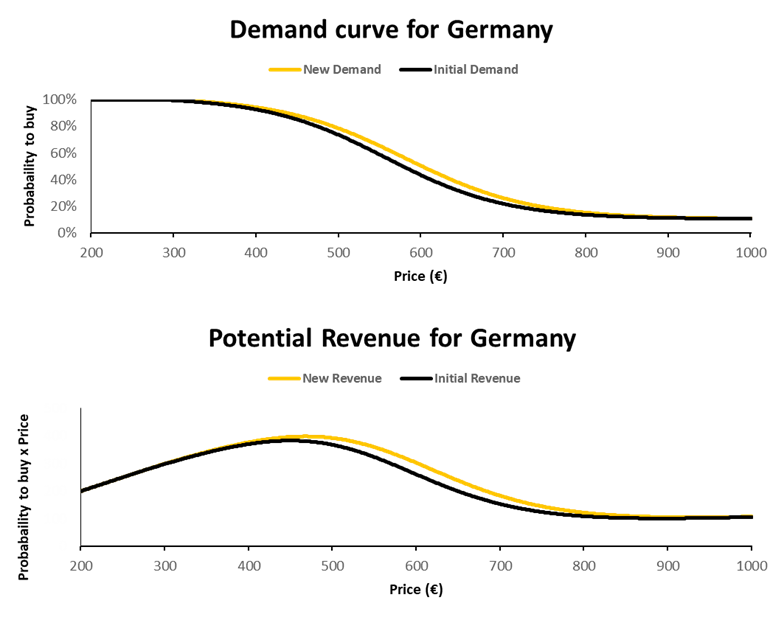

A more advanced Predictive AI model can take into account some or all of these factors and shift the Demand curve to reflect their impact. This enables the creation of multiple what-if scenarios to reveal new predictive insights for varying country, market, product, or customer conditions (Fig. 4).

Fig. 4 Multiple what-if scenarios for varying country, market, product, or customer conditions

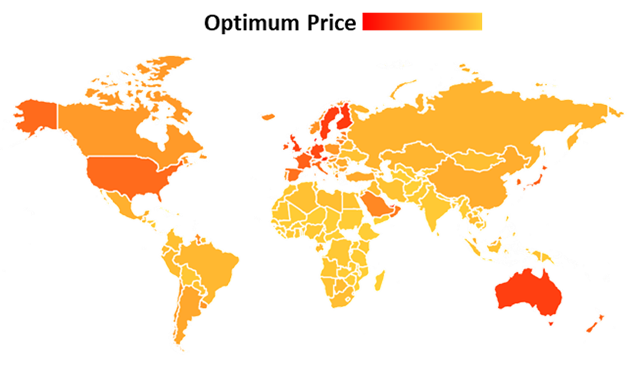

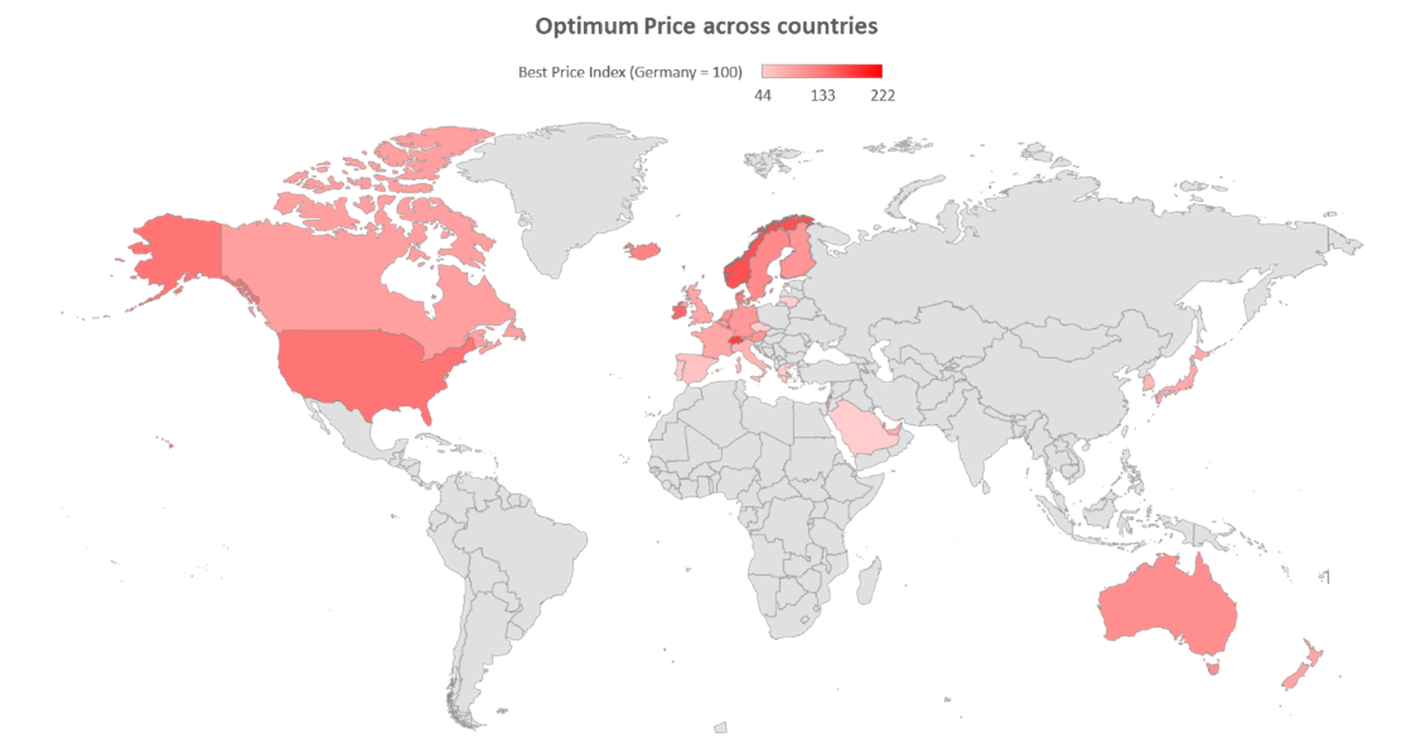

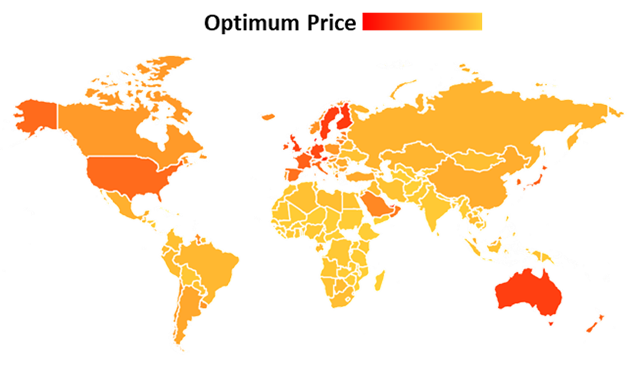

One of the benefits of having a Predictive AI model that understands, among other things, country dynamics is that you can get differentiated price suggestions and sales performance estimates across countries.

Fig. 5 AI-powered Price or other KPI Heat Maps

For instance, you can create heat maps (Fig. 5) indicating the differences among countries in terms of suggested best prices, expected revenue, penetration levels, or other vital indicators. And you can update these maps automatically when something significant changes, like inflation or the average spending capacity per country.

Real-life case: Combining Predictive AI with Neuroscience to identify the Best Price across countries for a new product launch(7)

This is the story of the launch of a new product, Scent Camera, a revolutionary device created by a team of scientists in Lithuania. The extraordinary device will forever change the way we experience the digital world. Scent Camera is a technological marvel that allows you to capture and experience smells based on a novel gadget. It’s now possible to witness the captivating aroma of freshly baked cookies or the invigorating scent of a tropical paradise right from the comfort of your own home. With Scent Camera, you can fully communicate a world of fragrances like never before.

The pricing challenge

Apart from the technological breakthrough needed for such an accomplishment, Scent Camera faced another challenge, i.e., how to price such a unique device, especially when this is a new market with no past sales, no competition, or any other point of reference to use. Even more, how to differentiate pricing per country, considering the relative strength and potential of local markets, and prioritize product launch accordingly.

The solution

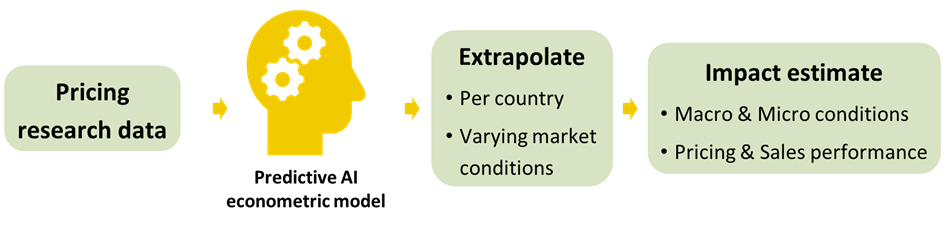

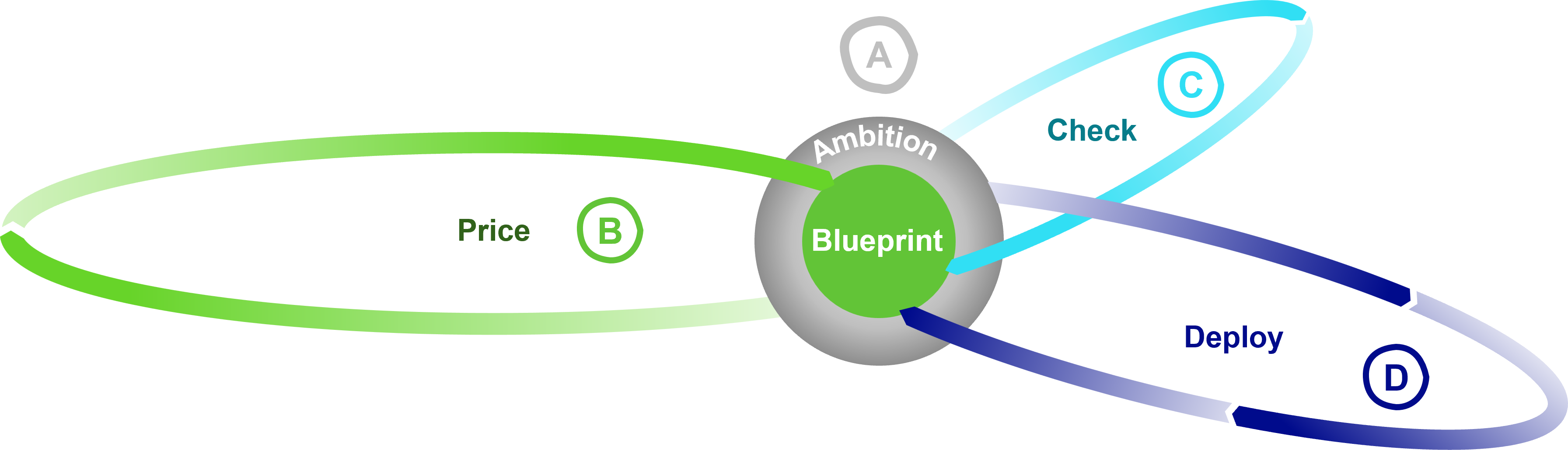

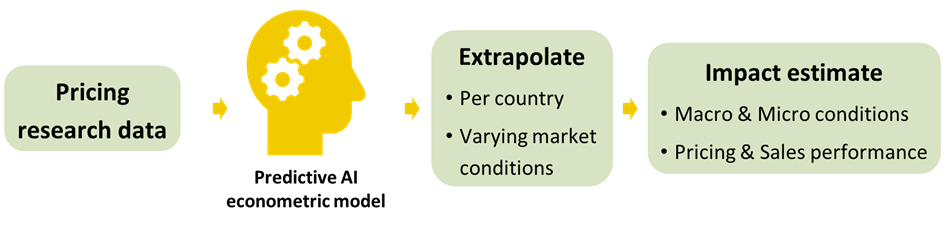

To discover the Ideal Go-To-Market Price, FutureUP and Neurensics jointly followed a two-step approach to help them address these challenges (Fig. 6):

- Pricing research data: First, Neurensics, armed with their groundbreaking NeuroPricing™ approach, delved deep into the subconscious responses of consumers in Germany, the first go-to-market. The technology is driven by assessing the subconscious mind via a brain scan-validated reaction time test where pricing decisions are made without us even realizing it.

- Predictive AI insights: Then, FutureUP combined the results with its innovative Predictive AI technology to generate price suggestions for other countries where no research data existed. Behind FutureUP’s technology lies a specialized econometric AI model, which considers various country or market conditions, like spending capacity, inflation, or other macro indicators, and predicts their impact on pricing and sales performance.

Fig. 6 The solution powered by Predictive AI

The result & benefit

By combining Predictive AI with Neuroscience, FutureUP and Neurensics jointly delivered:

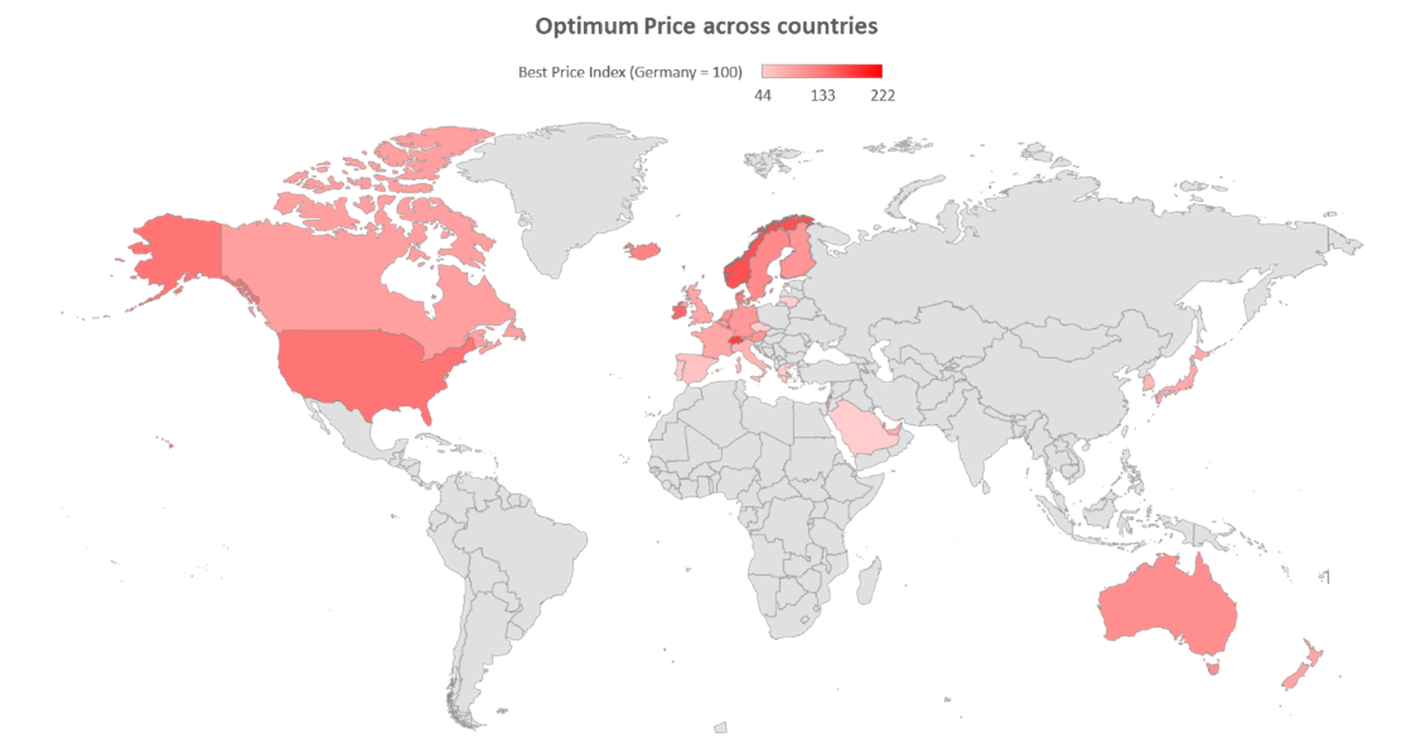

- A set of suggested Optimum Prices, maximizing revenue, for 40 countries (Fig. 7)

- A set of suggested Safe/Penetration Prices, ensuring more than 90% win probability, for 40 countries

- Expected Revenue and Penetration Levels (probability to win/buy) for the suggested prices

- What-if scenarios that automatically adjust price suggestions and probability to win for inflation and spending income for each country (see an example for Germany in Fig. 8)

Fig. 7 Optimum Price to maximize revenue across countries

Fig. 8 Example what-if scenario for Germany in 2024 with expected inflation at 3% and income growth at 1% (New expected demand/revenue in 2024 vs. Initial demand/revenue in 2023)

The accuracy of predictions regarding the probability to buy at each price level was extremely high, with less than 2.5% error, for in & out-of-sample testing, even with a sample as small as 15%.

The result provided Scent Camera with a pricing and penetration roadmap for numerous countries around the world, thus facilitating its go-to-market strategy for the new product.

Supply – Demand dynamics and Pricing Trends

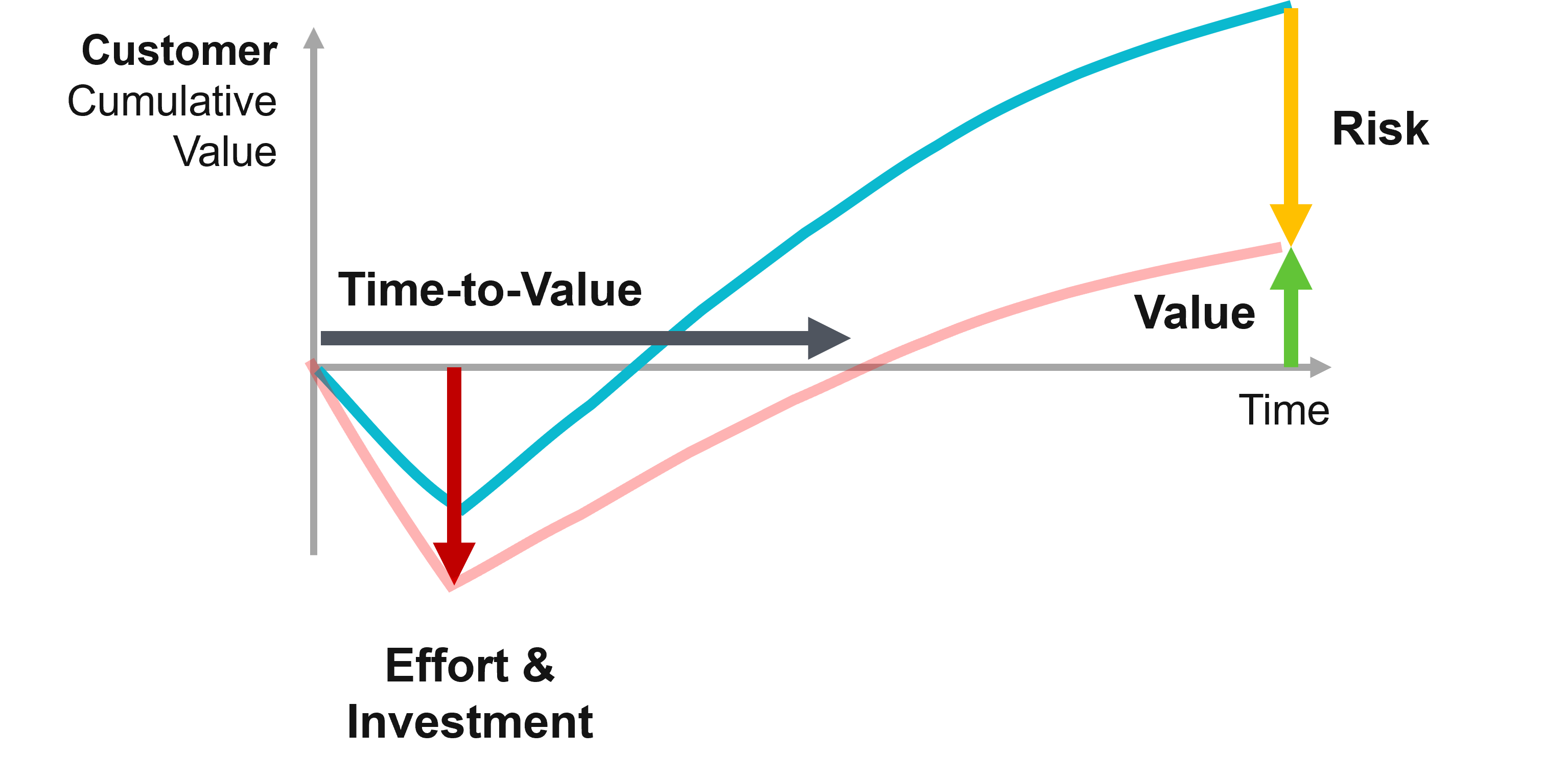

The Demand/Customer dynamics we explored so far is one side of the coin. This will suffice if supply dynamics are not so important, for instance, when there is no threat of supply shortages and the variable cost is low and, therefore, suppliers are more flexible with their pricing.

Although this may be true to some extent in several cases, there are many markets like commodities or the energy sector where supply dynamics play an important role in pricing and overall sales performance. A recent example is what happened in 2022 when supply stresses in energy and certain commodities led to a price increase and the biggest inflation of the past ten years.

But what initiates these dynamics?

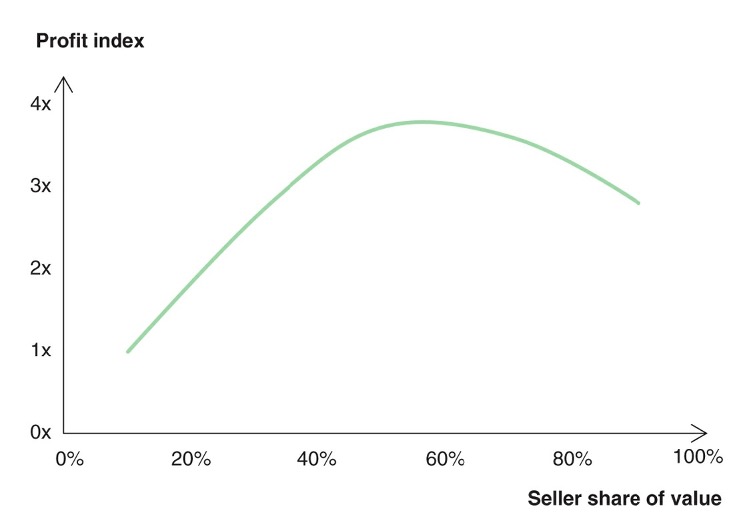

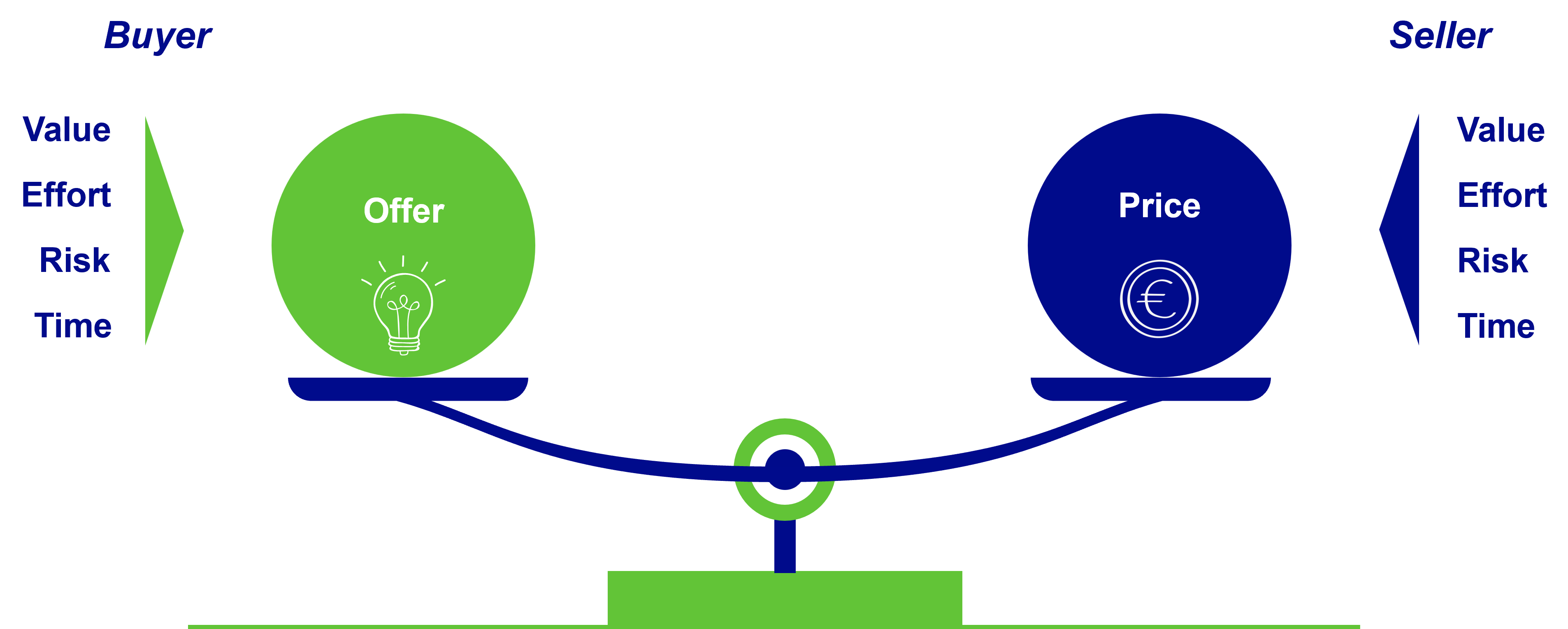

Every day, buyers interact with sellers, and the result is a potentially successful sales transaction. The seller is happier when prices increase and seeks to improve or optimize a KPI, for instance, to maximize revenue or profitability. The buyer, on the other side, is happier when prices decrease and seeks to maximize the value derived from the purchased product or offering at the lowest cost possible. All these dynamics are famously reflected in the Supply-Demand curve (Fig. 9).

Fig. 9 Supply vs. Demand curve

The role of Predictive AI here is to simulate the Supply curve on top of the Demand curve and generate additional predictive insights, and more precisely, what will happen if demand is higher than supply (supply shortage) or lower than supply (supply surplus).

In many cases, it’s not only the demand that is unknown, but on top, neither the price nor the supply is given or known in advance. It is all part of a dynamic process where each side makes decisions and acts and the other responds following the supply or demand curve until an equilibrium is reached.

In its simplest form, you can use Predictive AI to estimate volume and revenue sales separately and then divide them to get an indication of the pricing trend. In its more sophisticated form, Predictive AI would simulate demand & supply dynamics (like in Fig. 9) and estimate price and volume shifts and their respective equilibriums using more advanced econometric predictive models.

Estimating pricing trends can be very useful, for instance, when we want to estimate the average price in the market and how this may change as a response to rising inflation, an economic slowdown, or a competitor changing prices.

Using Generative AI in Pricing

One of the most critical challenges in pricing is collecting relevant data found in an unstructured form. Anyone with the slightest selling experience knows that salespeople include internal comments on their CRM indicating, for instance, that they lost a case to a particular competitor at a specific price. Similar data can be found online when customers or potential customers post reviews, product assessments, prices, or information about competitors. The problem is that this information is not structured and, therefore, is challenging to get and analyze properly to aid decision-making.

But this is where Generative AI is strong, as anyone who has used ChatGPT can confirm. You can apply Generative AI models to unstructured content from internal or external sources and ask to look for specific information and structure it. Granted, you’ll face certain challenges since you’ll need to train the AI model for your specific business case and test it thoroughly to your satisfaction, but still, it is worth your time to obtain a structured and cleansed data set for your sales and pricing decision-making.

Generative or other types of AI can also be used to automate pricing processes and workflows or to enhance user experience while performing price-related tasks.

Final remarks

Evidence suggests that Predictive AI, incorporating econometric modeling, can help optimize pricing and increase revenue and other important KPIs even 2-fold while improving strategic business foresight with great accuracy, reaching 97%6.

The simple reason you cannot beat this performance by using your instinct, experience, or base data analysis is the complexity of the Pricing premise involving so many different parameters at the macro, market, product, and customer levels. Using Predictive AI can help quantify pricing and sales dynamics and answer many important questions:

- Macro environment impact: What will happen if inflation, spending capacity, exchange rates, or other macro indicators change?

- Market impact: What will happen if competitors' pricing, market size, or other market conditions change?

- Product impact: What will happen if you offer more value with your products, package features differently, or improve the perceived quality of your offering?

- Customer impact: What will happen if you target customers of different market segments based on geography, size, type, or other customer characteristics?

- Key drivers:Which of the above are the most important drivers of growth, profit, or other important KPIs?

- Price optimization:What is the best price to optimize revenue, profits, or other KPIs, considering all or some of these factors?

- Price discrimination: Should you differentiate prices across countries, different market segments, or per customer?

- Dynamic pricing: How should you adjust pricing in real-time to reflect changes in demand vs. supply, competitors' intelligence, customer profile or history, or other parameters?

- Competition-based pricing:How should you adjust pricing in response to competitors' pricing?

- Pricing and packaging:Should you pack or bundle your offering in a certain way, including certain specifications or characteristics, to boost sales performance and product acceptance?

- Pricing trends:How does the average price in the market evolve, and are there any emerging trends that you should be aware of?

- Market intelligence: What is the value and trend of key market indicators like churn or market shares against key competitors?

AI, especially Predictive AI, can help you boost your business performance and get the most out of your pricing while improving strategic foresight. The right AI technologies and predictive models already exist, creating value for large or small businesses across industries worldwide. So, don’t let yourself fall behind; take the lead by embracing the AI revolution and seize this excellent opportunity to supercharge your Pricing!

(1) Danilo Zatta, “The Pricing Model Revolution: How Pricing Will Change the Way We Sell and Buy On and Offline”, 2022, Wiley

(2) Based either on material or reproduced partly or fully from: https://www.futureup.io/post/please-pay-attention-to-your-pricing

(3) McKinsey Technology Trends Outlook 2023: https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-top-trends-in-tech

(4)You can see more information regarding this customer case here: https://www.futureup.io/post/combining-predictive-ai-with-neuroscience-to-identify-the-best-price-across-countries

(5) Based either on material or reproduced partly or fully from: https://www.futureup.io/predict

(6) You can check out more AI success stories and evidence of Predictive AI’s positive contribution here: https://www.futureup.io/news/categories/success-stories

(7) https://www.neurensics.com/en/discover-why-neuropricing-is-the-key-to-uncover-the-ideal-price

(8) You can find more information here: https://www.futureup.io/post/pricing-inflation

Disclaimer

All content included in this article is reproduced with the explicit permission of the author, George Boretos, and is subject to the following conditions:

(a) The content provided by George Boretos may only be used for the purpose of inclusion within the aforementioned article and for related promotional activities.

(b) No Intellectual Property, including but not limited to copyrights, trademarks, patents, and any other rights associated with creative works, is transferred from George Boretos, his company FutureUP, or any third parties. The author and his associated parties retain full ownership of all such rights and, for the avoidance of doubt, do not require separate permission to reproduce, in part or in full, or create derivative works based on any materials contributed and included in this article.